santa clara property tax due date 2021

First installment of taxes due covers July 1 December 31st. The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm.

Santa Clara County Ca Property Tax Calculator Smartasset

Ultimate Santa Clara Real Property Tax Guide for 2021.

. On Monday April 12 2021. Learn all about Town Of Santa Clara real estate tax. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time.

Tax payments must be received or postmarked by the due date to avoid penalties. Second installment of secured taxes due. On Monday April 11 2022.

Today is November 5th 2018 so. Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Save time - e-File your Business Property Statement.

The following table shows the filing deadline for each county. County of Santa Clara TAX YEAR. Taxes due for July through December are due November 1st.

This date is not expected to change due to COVID-19 however assistance is available to individual. The 25 best Property Tax Santa Clara Due Date images and discussions of May 2022. Due date for filing statements for business personal property aircraft and boats.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Make checkmoney order payable to SF Tax Collector. Santa clara county property tax due date 2022.

Non-refundable processing fee of 25. Home - Department of Tax and Collections - County of Santa Clara. 2021-22 East Wing 6th Floor For July 01 2021 through June 30 2022 San Jose California 95110-1767 ASSESSORS PARCEL NUMBER APN.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. The fiscal year for Santa Clara County Taxes starts July 1st. The property tax rate in Santa Clara County where Santa Clara is located is 073 or 6650 per year.

AUGUST 31 - Unsecured Property Tax payment deadline. Designed for most business owners E-filing is a free application no downloading required that allows businesses to quickly and securely file their Business Property Statement 571-L via the. Dec 29 2021.

The first installment is due on Nov. As the official tax due date falls on Saturday April 10 when the physical office is closed the deadline for all payments is. If a payment is received after the due date with no postmark the payment is considered late and penalties will be imposed.

Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143. SEPTEMBER 1 - Unpaid Unsecured Property Taxes are transferred to the Collections Division. 2021-2022 for July 01 2021 through June 30 2022 ASSESSORS PARCEL NUMBER APN.

Apr 21 2020 SAN JOSE The Santa Clara County Board of Supervisors today voted unanimously 5-0 on Supervisor Joe Simitians proposal for the County to waive the 10 penalty on property tax payments that were due Friday April 10 but that were paid late. Find Santa Clara County Online Property Taxes Info From 2021. Due Date for filing Business Property.

If they are not paid by December 10th they become delinquent. Santa Clara County Cant Change When Property Taxes Are Due. Although you might expect the two bills to be due payable 6 months apart thats not how it works.

SANTA CLARA COUNTY CALIF. Payments are due as follows. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. Studying this recap youll acquire a good perception of real property taxes in Santa Clara and what you should be aware of when your payment is due. Installment 2 is due February 1 and is delinquent April 10th.

Installment 1 is due November 1 and is delinquent December 10th. Business Property Statements are due April 1. This date is not expected to change due to COVID-19 however assistance is.

Trending posts and videos related to Property Tax Santa Clara Due Date. The regular appeals filing period will begin on July 2 2021 in each county and will end either on September 15 or November 30 depending on whether the C ounty Assessor has elected to mail assessment notices by August 1 2021 to all taxpayers with property on the secured roll. If they are not paid by April 10th they become delinquent.

A 10 penalty plus 30 collection fee are added if not postmarked by August 31 received in our office as of 500 pm or before midnight online. Deadline to file all exemption claims. Santa clara county property tax due date 2022.

District Attorney Jeffrey Rosen. 12345678 Enter Account Number. On Monday April 12 2021.

067 of home value. 296-42-227 DELINQUENT TAX DUE. Second installment of taxes due covers Jan 1 June 30.

Taxes due for January through June are due February 1st. Make checkmoney order payable to SF Tax Collector. If you are already a resident.

Office of the Treasurer Tax Collector. Include Block and Lot number on memo line. May 27 2021 Property Tax Santa Clara Due Date Since the political mind and authorizes the states per the property due.

Property Tax Santa Clara Due Date. Novogratz brittany futon sofa April 26 2022 0 Comments 802 pm. Property Tax Email Notification lets you.

Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April.

Sacramento County Ca Property Tax Search And Records Propertyshark

California Mortgage Calculator Smartasset

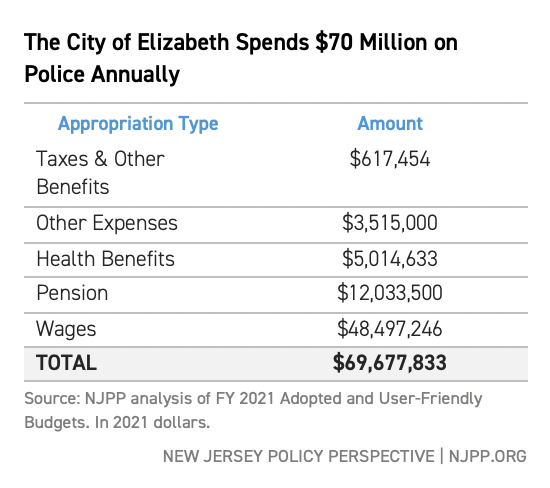

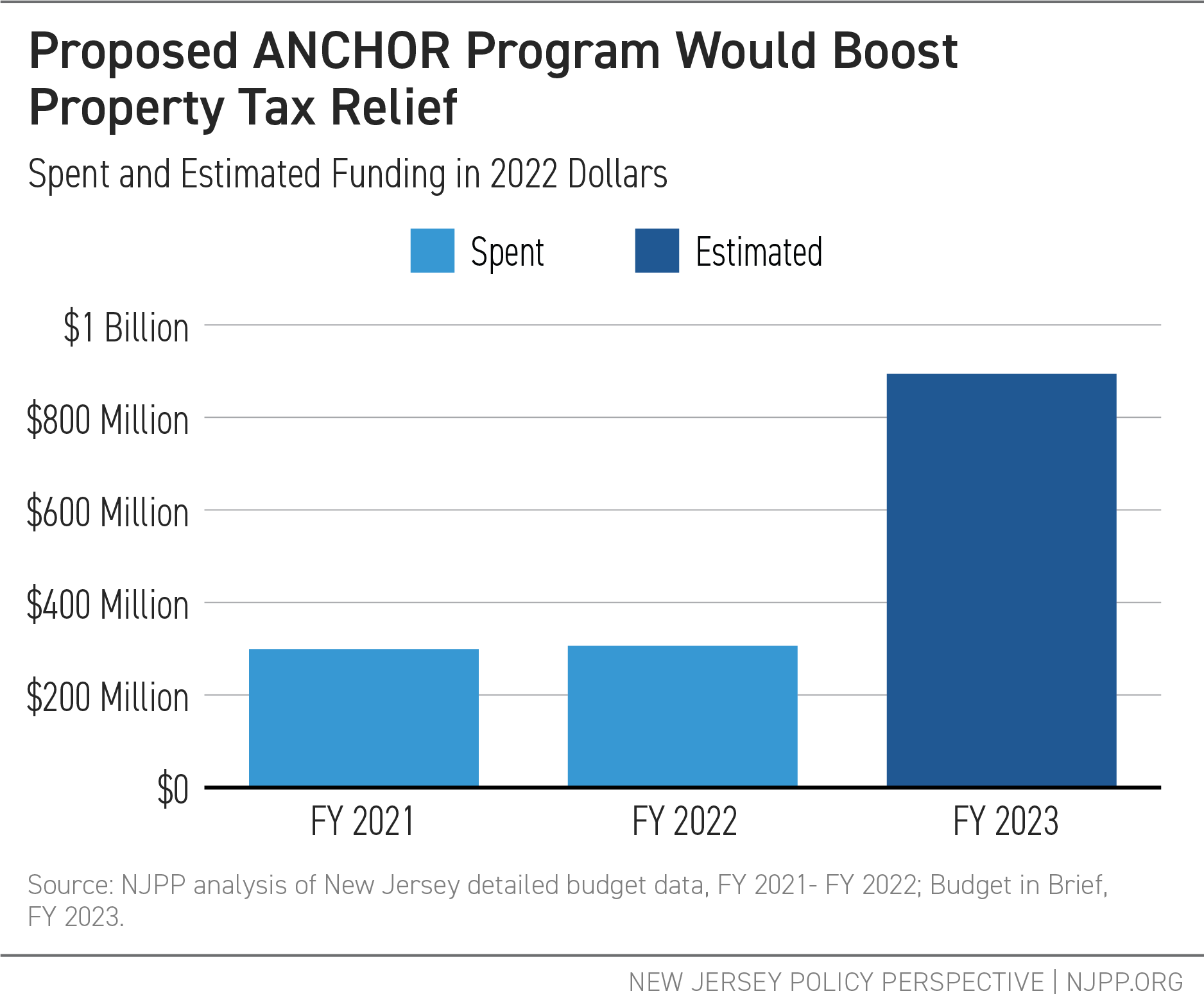

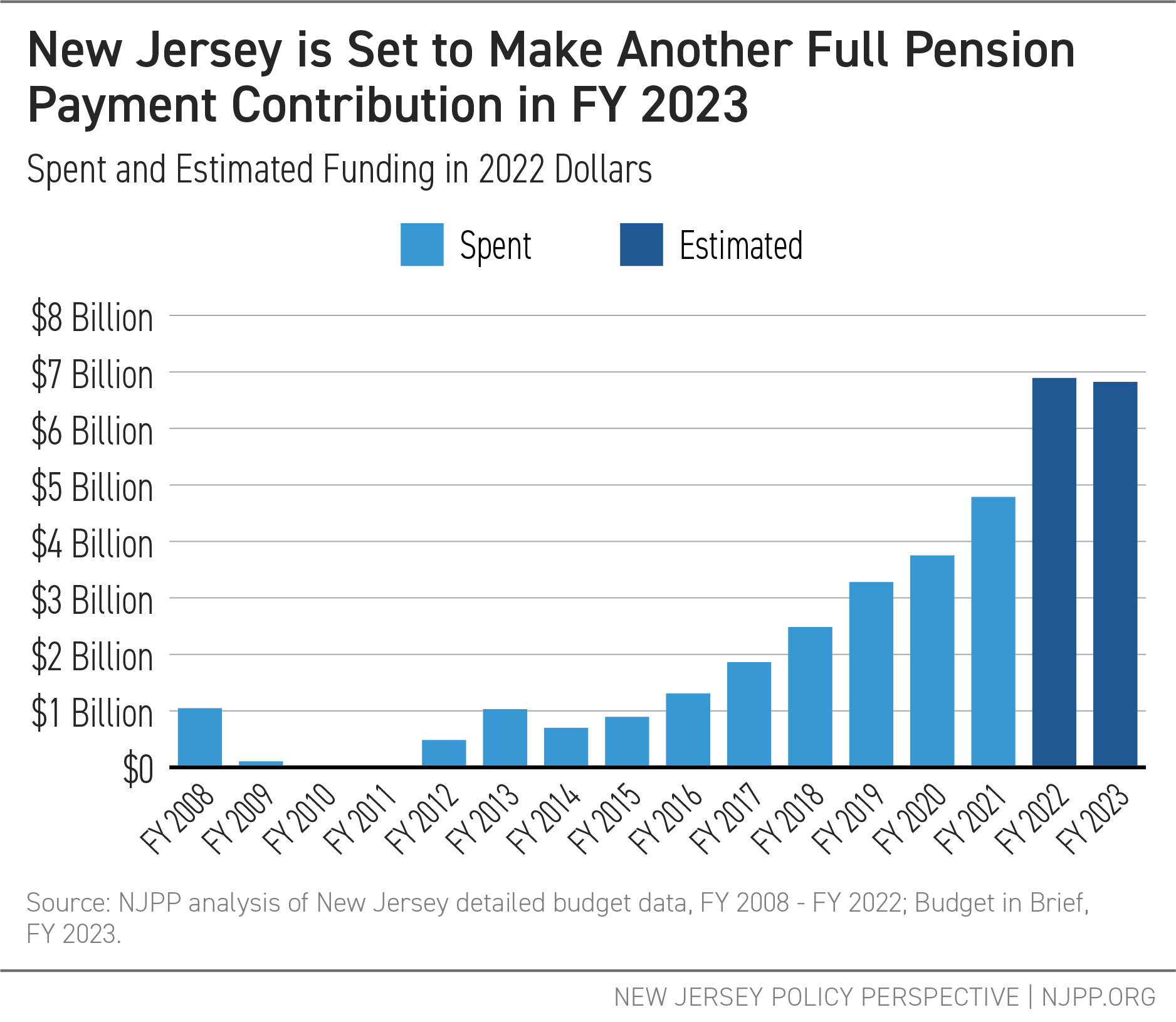

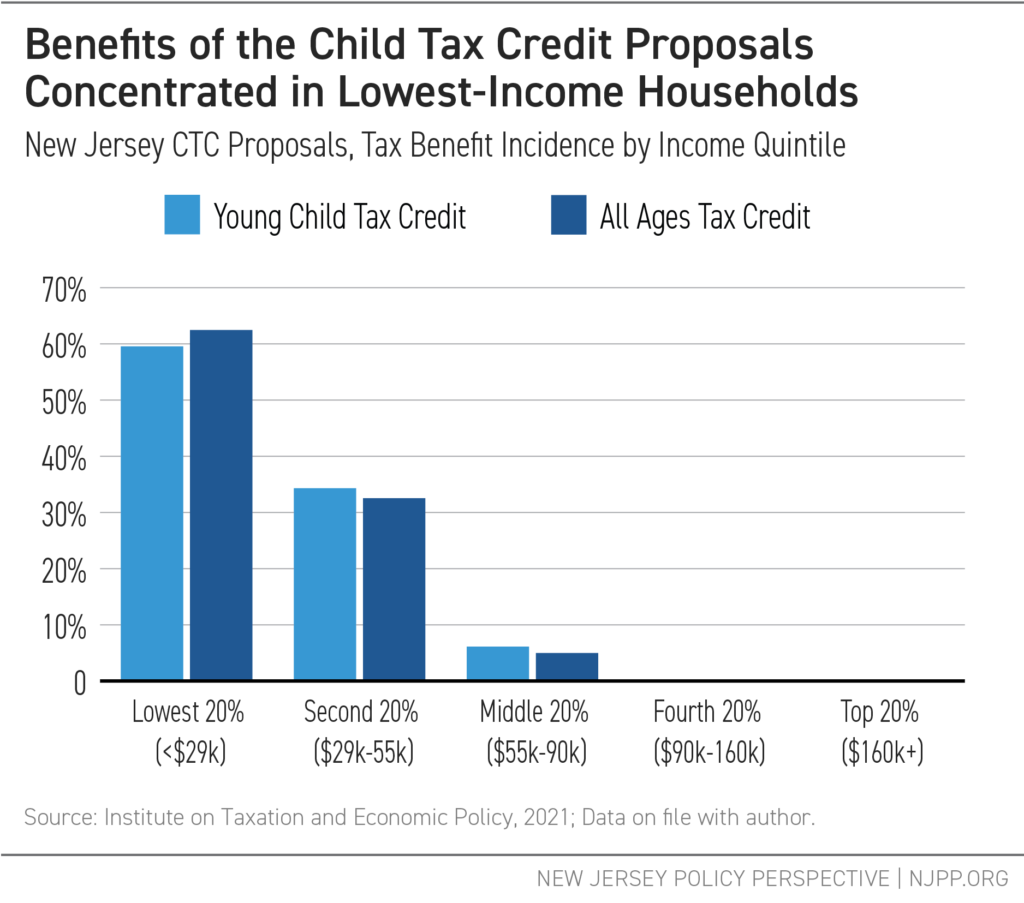

Report Archives New Jersey Policy Perspective

Santa Clara County Ca Property Tax Calculator Smartasset

Report Archives New Jersey Policy Perspective

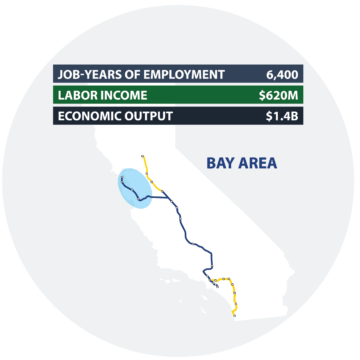

Economic Investment California High Speed Rail

Santa Clara County Ca Property Tax Calculator Smartasset

Renters Form A Group To Fight For Their Rights News Palo Alto Online

Report Archives New Jersey Policy Perspective

Sacramento County Ca Property Tax Search And Records Propertyshark

Report Archives New Jersey Policy Perspective